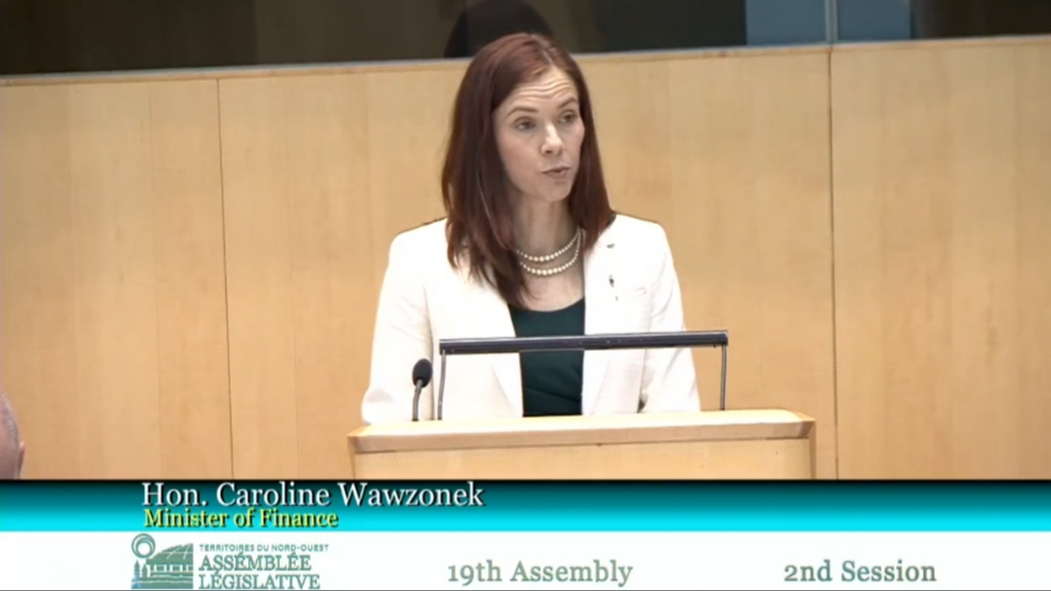

Finance Minister Caroline Wawzonek brought a bill forward in the Legislative Assembly that would halve the territorial small business tax rate.

Bill 16, which was presented for its first reading, would amend the Income Tax Act by dropping the small business tax rate from four percent to two percent.

The bill would come into effect from January 1, 2021 if it passes the legislature. The bill must go through two further readings.

The Yellowknife Chamber of Commerce applauded Wawzonek’s “innovative approach to budgeting” on Twitter. The chamber president Tim Syers also applauded the move by Wawzonek.

“I don’t think there are many other jurisdictions lowering taxes these days.”

Small Business Tax Reduction in #NWT!

1st reading for reduction from 4% to 2%.

Excellent news for many @YKChamber members.

Kudos – @CWawzonek #GNWT – I don’t think there are many other jurisdiction lowering taxes these days. https://t.co/dlSQSkSEfC

— Tim Syer (@MTSyer) October 31, 2020

Wawzonek spoke about making significant changes as part of a new “creative” model of budgeting, during her remarks in front of the Legislative Assembly on Friday. “Government renewal” as the restructuring has been dubbed, is aimed at reducing past inefficiencies and making planning more proactive, Wawzonek said.

“Over multiple Legislative Assemblies, the data shows patterns of budgeting and spending that have impaired the long-term sustainability of the GNWT,” said Wawzonek in the Legislative assembly on Friday.

”Our expenditures and the public service continue to grow … and the significant capital investments which the territory absolutely needs have driven up our short-term debt.”

Wawzonek said she would shift the GNWT to a priority based budgeting, which emphasizes programs and services “that are most critical and valuable to residents.”

“This is a fundamental shift from how budgets are currently developed, where a large focus is on incremental increases and decreases from the year before,” said Wawzonek.

“Using incremental budgeting, most of the budget is not actually subject to the same level of scrutiny as new spending and it can be difficult to respond to new or changing priorities.

This change will require significant work, said Wawzonek, but provides an opportunity for the GNWT to “better reflect the diversity of the values and needs of all residents of the NWT.”

“Incremental budgeting is more about where we have been,” she said. “But now, we want to define our fiscal foundation by where we want to go.”